Chapter 9: Competing in International Markets

9.2 Advantages and Disadvantages of Competing in International Markets

Kia Picks Up Speed

On June 2, 2011, South Korean automaker Kia announced plans for a major expansion of its American production facility. Capacity at Kia Motors Manufacturing Georgia Inc. (KMMG) was slated to expand 20% from 300,000 to 360,000 vehicles per year. In addition to the crossover utility vehicle Sorento, the plant would begin making a sedan named the Optima in September 2011. The expansion of the plant was estimated to cost $100 million and was expected to create 1,000 new jobs (Sands, 2011).

This ambitious growth was made possible by Kia’s superb performance in the US market. KMMG had started building vehicles less than two years earlier after being constructed for a cost of $1 billion. In 2010, yearly sales in the United States climbed above 350,000 vehicles. Kia’s overall share of the US market increased in 2010 for the sixteenth consecutive year. In May 2011, Kia sold more than 48,000 cars and trucks in the United States, an increase of more than 53% from May 2010 sales levels. The Optima led the way with a whopping 210% increase in sales.

Kia was not the only beneficiary of its success. KMMG’s location of West Point, Georgia, had been economically devastated when its homegrown textile company, WestPoint Home, shut down its local factories to take advantage of lower labor prices overseas. Following a fierce competition with towns in Mississippi, Kentucky, and other states, West Point was selected in 2006 as the site of Kia’s first US manufacturing facility. To win the plant, state and local authorities offered Kia more than $400 million worth of incentives, including tax breaks, free land, and infrastructure creation. This kind of governmental inducement has become commonplace when states lure new businesses to a region. This practice is also an example of “corporate welfare.”

Georgia’s return on this investment included two thousand new jobs at the plant as well as hundreds of jobs at suppliers that set up shop to support KMMG. The neighboring state of Alabama benefited from KMMG’s success too. As of June 2011, nearly sixty companies spread across twenty-three Alabama counties supplied parts or services to KMMG (Kent, 2011).

The name “Kia” means to arise or come up out of Asia (Kia, n.d.). This name is very appropriate; Kia rose from humble beginnings as a maker of bicycle parts in 1944 to become a global player in the automobile industry. As of 2011, Kia was producing more than 2.1 million vehicles per year in eight countries. Kias were sold in 172 countries. Kia employed more than 44,000 people and enjoyed annual revenues in excess of $20 billion. Fellow South Korean automaker Hyundai owned just over 33% of Kia, and the two firms strengthened each other through collaboration. When taking all of these facts into consideration, Kia’s slogan—”The Power to Surprise”—had to make its rivals wonder what surprises the Korean upstart might have in store for them next.

As Kia’s experience illustrates, international business is a huge segment of the world’s economic activity. Amazingly, current projections suggest that, within a few years, the total dollar value of trade across national borders will be greater than the total dollar value of trade within all of the world’s countries combined. One driver of the rapid growth of internal business over the past two decades has been the opening up of large economies such as China and Russia that had been mostly closed off to outside investors.

International strategy is determining how to do business outside the borders of a firm’s home country. International business has opened up significantly in the last few decades. This has been due to lower trade barriers, improved communications, more efficient shipping via ship and airplane, and the internet. Many US companies have shifted their manufacturing and supply chain activities abroad, where labor is cheaper and overall costs are reduced, even with the additional costs of shipping. The COVID-19 pandemic of 2020 illustrated some issues that emerge when an economy, such as with the US, becomes dependent on other countries for the materials it uses for its final products. During the pandemic, the capacity for global supply chains to meet the sharp increase in demand for paper goods, cleaning supplies, as well as for medications and other medical equipment and supplies, was immediately strained.

International strategy for a firm can be somewhat minimal, such as procuring needed supply chain resources for manufacturing a product in the home country, to an expanded role, like exporting products for sale in other countries, to full manufacturing subsidiaries such as the Kia example in the US. There are multiple reasons why a firm would go international, and also multiple advantages and disadvantages.

The domestication of the camel by Arabian travelers fueled two early examples of international trade: spices and silk. Today, camels have been replaced by airplanes, trains, and ships, and international trade is more alluring than ever. Here are three key reasons why executives are enticed to enter new markets.

| Access to new customers | China’s population is roughly four times as large as that of the United States. While political, cultural, and economic differences add danger to trade with China, the immense size of the Chinese market appeals to American firms. |

| Lowering costs | Access to cheaper raw materials and labor have led to considerable outsourcing and offshoring. Call centers in India have become so sophisticated that many Indian customer service representatives take extensive language training to learn regional US dialects. |

| Diversification of business risk | Business risk refers to the risk of an operation failing. Competing in multiple markets allows this risk to be spread out among many economies and customers. Coca-Cola, for example, has a presence in over 200 markets worldwide. |

The United States enjoys the world’s largest economy. As an illustration of the power of the American economy, consider that in 2018, the economy of just one state—California—was the fifth largest in the world. If it were a country, it would rank between Germany and the United Kingdom (CBS News, 2018). The size of the US economy has led American commerce to be very much intertwined with international markets. In fact, it is fair to say that every business is affected by international markets to some degree. Tiny businesses such as individual convenience stores and clothing boutiques sell products that are imported from abroad. Meanwhile, corporate goliaths such as General Motors (GM), Coca-Cola, and Microsoft conduct a great volume of business overseas.

Access to New Customers

Perhaps the most obvious reason to compete in international markets is gaining access to new customers. Although the United States enjoys the largest economy in the world, it accounts for only about 5% of the world’s population. Selling goods and services to the other 95% of people on the planet can be very appealing, especially for companies whose industry within their home market is saturated (Table 9.1).

Few companies have a stronger “All-American” identity than McDonald’s. Yet McDonald’s is increasingly reliant on sales outside the United States. In 2006, the United States accounted for 34% of McDonald’s revenue, while Europe accounted for 32% and 14% was generated across Asia, the Middle East, and Africa. By 2011, Europe was McDonald’s biggest source of revenue (40%), the US share had fallen to 32%, and the collective contribution of Asia, the Middle East, and Africa had jumped to 23%. By 2019, McDonald’s US percent of total revenue had grown to 41% (Statista, 2019). With less than half of its sales being generated in its home country, McDonald’s is truly a global powerhouse.

China and India have been attractive markets to US firms. The countries are the two most populous in the world. Both nations have growing middle classes, which means they have been building infrastructures, like education and transportation systems, that support increased purchasing power. In other words, individuals in these countries can buy goods and services that are not merely necessities of life. This trend has created tremendous opportunities for some firms. In 2019, for example, GM sold more vehicles in China than it sold in the United States (3.1 million vs. 2.9 million). This gap has continued from at least 2010. (Reuters, 2020).

Lowering Costs

Many firms that compete in international markets hope to gain cost advantages. If a firm can increase its sales volume by entering a new country, for example, it may attain economies of scale that lower its per unit production costs. Going international also has implications for dealing with suppliers. The growth of overseas expansion leads many businesses to purchase supplies in greater numbers. This can provide a firm with stronger leverage when negotiating prices with its suppliers.

Offshoring has become a popular yet controversial means for trying to reduce costs. Offshoring involves relocating a business activity to another country. Many American companies have closed down operations at home in favor of creating new operations in countries such as China and India that offer cheaper labor. While offshoring can reduce a firm’s costs of doing business, the job losses in the firm’s home country can devastate local communities. For example, West Point, Georgia, lost approximately 16,000 jobs in the 1990s and 2000s as local textile factories were shut down in favor of offshoring (Copeland, 2010). Fortunately for the town, Kia’s decision to locate its first US factory in West Point has improved the economy in the past few years. In another example, Fortune Brands saved $45 million a year by relocating several factories to Mexico, but the employee count in just one of the affected US plants dropped from 1,160 to 350.

A growing number of US companies are finding that offshoring is not providing the benefits they had expected. This has led to a new phenomenon known as reshoring, whereby jobs that had been sent overseas are returning home. In some cases, the quality provided by workers overseas is not good enough. Carbonite, a seller of computer backup services, found that its call center in Boston was providing much stronger customer satisfaction than its call center in India. The Boston operation’s higher rating was attained even though it handled the more challenging customer complaints. As a result, Carbonite shifted 250 call center jobs back to the United States.

In other cases, the expected cost savings have not materialized. NCR had been making ATMs and self-service checkout systems in China, Hungary, and Brazil. These machines can weigh more than a ton, and NCR found that shipping them from overseas plants back to the United States was extremely expensive. NCR hired 500 workers to start making the ATMs and checkout systems at a plant in Columbus, Georgia, adding 370 more jobs (Isidore, 2011). Similarly, Apple, General Motors, Boeing, and Ford had brought back thousands of jobs each to the US from abroad by 2019 (Monroe Engineering, 2018).

Diversification of Business Risk

A familiar cliché warns “don’t put all of your eggs in one basket.” Applied to business, this cliché suggests that it is dangerous for a firm to operate in only one country. Business risk refers to the potential that an operation might fail. If a firm is completely dependent on one country, negative events in that country could ruin the firm. Just like spreading one’s eggs into multiple baskets reduces the chances that all eggs will be broken, business risk is reduced when a firm is involved in multiple countries.

Consider, for example, natural disasters such as the earthquakes and tsunami that hit Japan in 2011. If Japanese automakers such as Toyota, Nissan, and Honda sold cars only in their home country, the financial consequences could have been grave. Because these firms operate in many countries, however, they were protected from being ruined by events in Japan. In other words, these firms diversified their business risk by not being overly dependent on their Japanese operations.

American cigarette companies such as Philip Morris and R. J. Reynolds are challenged by trends within the United States and Europe. Tobacco use in these areas is declining as more laws are passed that ban smoking in public areas and in restaurants. In response, cigarette makers are attempting to increase their operations within countries where smoking remains popular to remain profitable over time.

For example, Philip Morris spent $5.2 billion to purchase a controlling interest in Indonesian cigarette maker Sampoerna. This was the biggest acquisition ever in Indonesia by a foreign company. Tapping into Indonesia’s population of approximately 230 million people was attractive to Philip Morris in part because nearly two-thirds of men are smokers, and smoking among women is on the rise. At the time, Indonesia was the fifth-largest tobacco market in the world, trailing only China, the United States, Russia, and Japan. To appeal to local preferences for cigarettes flavored with cloves, Philip Morris introduced a variety of its signature Marlboro brand called Marlboro Mix 9 that includes cloves in its formulation (The Two Malcontents, 2007).

The use of PESTEL can be a valuable tool in assessing the risk for a firm considering international diversification. Analyzing the industry within the target country could provide valuable insights on whether to enter that market or not. For example, if Apple were to consider shifting some of its product manufacturing to India, what do the PESTEL forces reveal for the Indian IT industry?

| Political | Moderate, positive & negative: Stable government, democracy, international companies highly regulated |

| Economical | Strong, positive: Low cost labor, IT has strong growth |

| Socio-cultural | Strong, positive: Many speak English, strong STEM education |

| Technological | Strong, positive: Strong growth |

| Ecological | Weak |

| Legal | Moderate, negative: Highly regulated |

In conclusion, a PESTEL analysis reveals that overall it would be a positive move for Apple to do manufacturing in India, but will need to comply with many laws and regulations.

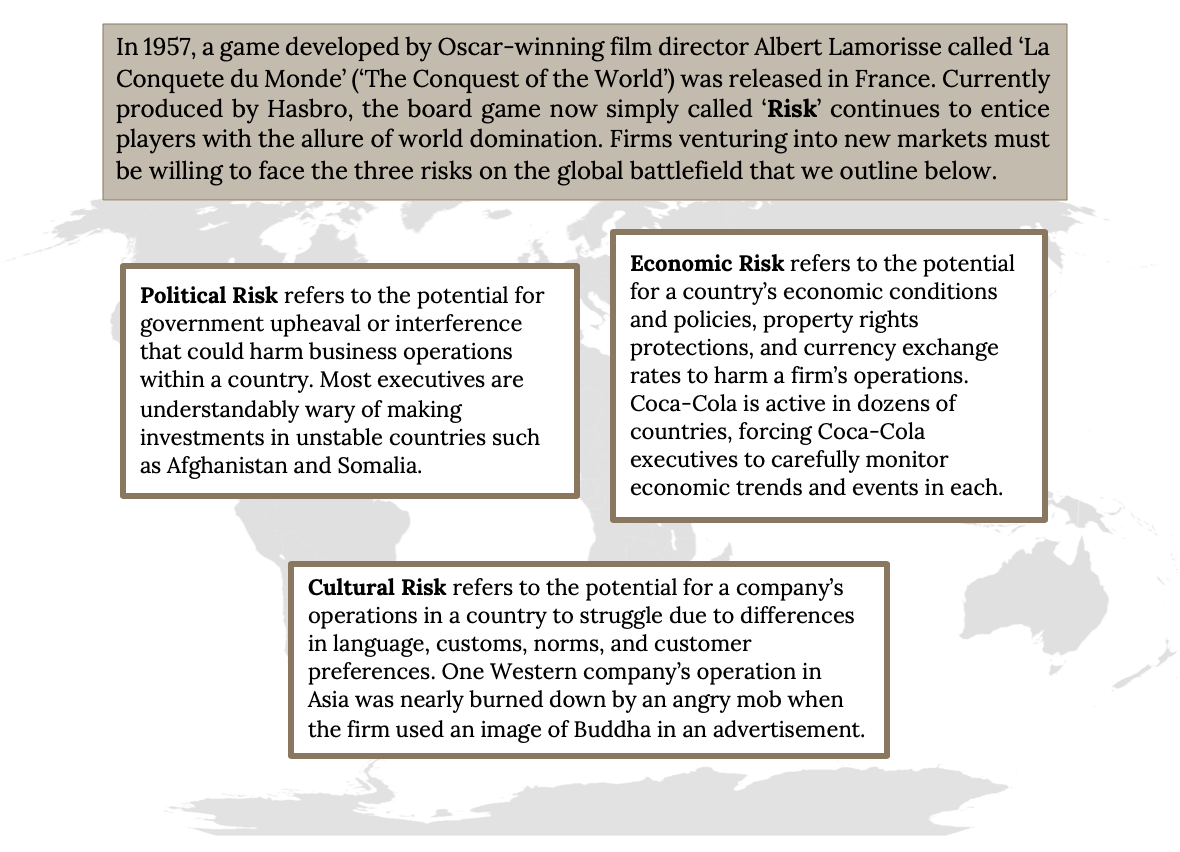

Political Risk

Although competing in international markets offers important potential benefits, such as access to new customers, the opportunity to lower costs, and the diversification of business risk, going overseas also poses daunting challenges. Political risk refers to the potential for government upheaval or interference with business to harm an operation within a country (Figure 9.1). For example, the term “Arab Spring” has been used to refer to a series of uprisings in 2011 within countries such as Tunisia, Egypt, Libya, Bahrain, Syria, and Yemen. Unstable governments associated with such demonstrations and uprisings make it difficult for firms to plan for the future. Over time, a government could become increasingly hostile to foreign businesses by imposing new taxes and new regulations. In extreme cases, a firm’s assets in a country are seized by the national government. This process is called nationalization. In recent years, for example, Venezuela has nationalized foreign-controlled operations in the oil, cement, steel, and glass industries. US oil companies were expelled from the country.

Countries with the highest levels of political risk tend to be those whose governments are so unstable that few foreign companies are willing to enter them because of the potential for physical violence and harm to life or property. High levels of political risk are also present, however, in several of the world’s important emerging economies, including India, the Philippines, and Indonesia. This creates a dilemma for firms in that these risky settings also offer enormous growth opportunities. Firms can choose to concentrate their efforts in countries such as Canada, Australia, South Korea, and Japan that have very low levels of political risk, but opportunities in such settings are often more modest (Kostigen, 2011).

Economic Risk

Economic risk refers to the potential for a country’s economic conditions and policies, property rights protections, and currency exchange rates to harm a firm’s operations within a country. Executives who lead companies that do business in many different countries have to take stock of these various dimensions and try to anticipate how the dimensions will affect their companies. Because economies are unpredictable, economic risk presents executives with tremendous challenges.

Consider, for example, Kia’s operations in Europe., Kia reported increased sales in ten European countries relative to the prior year. The firm enjoyed a 62% year-to-year increase in Slovakia, 58% in Austria, 50% in Gibraltar, 49% in Sweden, 43% in Poland, 24% in Germany, 21% in the United Kingdom, 13% in the Czech Republic, 6% in Belgium, and 3% in Italy (Kia, 2020). As Kia’s executives planned for the future, they needed to wonder how economic conditions would influence Kia’s future performance in Europe. If inflation and interest rates were to increase in a particular country, this would make it more difficult for consumers to purchase new Kias. If currency exchange rates were to change such that the euro became weaker relative to the South Korean won, this would make a Kia more expensive for European buyers.

Cultural Risk

The phrase “When in Rome, do as the Romans do” is used to encourage travelers to embrace local customs. An important part of fitting in is avoiding behaviors that locals consider offensive. Below we illustrate a number of activities that would go largely unnoticed in the United States but could raise concerns in other countries.

| Examples of Cultural Risk | |

| If you want to signal “Check please!” to catch the attention of your garçon in France and Belgium, remember that snapping your fingers is vulgar there. | |

| Provocative dress is embraced by many Americans, but many people in Muslim countries consider a woman’s clothing to be inappropriate if it reveals anything besides the face and hands. | |

| Do you pride yourself on your punctuality? You may be wasting your time in Latin American countries, where the locals tend to be about 20 minutes behind schedule. | |

| Do not eat with your left hand in India or Malaysia. That hand is associated with unclean activities reserved for the bathroom. | |

| In many Asian and Arabian countries, showing the sole of your shoe is considered rude. | |

| If everything is OK when you’re in Brazil, avoid making the “OK” hand signal. It’s the equivalent to giving someone the middle finger. | |

| Do not clean your plate in China. Leaving food on the plate indicates the host was so generous that the meal could not be finished. | |

| In Japan, direct eye contact is viewed as impolite. |

Cultural risk refers to the potential for a company’s operations in a country to struggle because of differences in language, customs, norms, and customer preferences (Table 9.2). The history of business is full of colorful examples of cultural differences undermining companies. For example, a laundry detergent company was surprised by its poor sales in the Middle East. Executives believed that their product was being skillfully promoted using print advertisements that showed dirty clothing on the left, a box of detergent in the middle, and clean clothing on the right. A simple and effective message, right? Not exactly. Unlike English and other Western languages, the languages used in the Middle East, such as Hebrew and Arabic, involve reading from right to left. To consumers, the implication of the detergent ads was that the product could be used to take clean clothes and make them dirty. Not surprisingly, few boxes of the detergent were sold before this cultural blunder was discovered.

A refrigerator manufacturer experienced poor sales in the Middle East because of another cultural difference. The firm used a photo of an open refrigerator in its print ads to demonstrate the large amount of storage offered by the appliance. Unfortunately, the photo prominently featured pork, a type of meat that is not eaten by the Jews and Muslims who make up most of the area’s population (Ricks, 1993). To get a sense of consumers’ reactions, imagine if you saw a refrigerator ad that showed meat from a horse or a dog. You would likely be disgusted. In some parts of the world, however, horse and dog meat are accepted parts of diets. Firms must take cultural differences such as these into account when competing in international markets.

Cultural differences can cause problems even when the cultures involved are very similar and share the same language. RecycleBank is an American firm that specializes in creating programs that reward people for recycling, similar to airlines’ frequent-flyer programs. When RecycleBank expanded its operations into the United Kingdom, executives at RecycleBank became offended when the British press referred to RecycleBank’s rewards program as a “scheme.” Their concern was unwarranted, however. The word scheme implies sneakiness when used in the United States, but a scheme simply means a service in the United Kingdom (Maltby, 2010). Differences in the meaning of English words between the United States and the United Kingdom are also vexing (Table 9.4).

Cultural differences rooted in language—even across English-speaking countries—can affect how firms do business internationally. Below we provide a few examples.

|

Cultural Differences in Language |

|

Book and movie titles are often changed in different markets to appeal to different cultural sensibilities. For example, British author J.K. Rowling’s Harry Potter and the Philosopher’s Stone was changed to Harry Potter and the Sorcerer’s Stone in the United States because of the belief that American children would find a philosopher to be boring. |

|

Moms in the states can be seen walking with strollers in their neighborhoods, while “mums” in Ireland and the United Kingdom keep their children moving in a buggy. |

|

In India, you are more likely to hear “no problem” than “no” as Indian nationals avoid the disappointment associated with using the word no. |

|

The area of a car called a trunk in America is known as the boot in England. |

|

Wondering what it means when a British friend asks, “What’s under your bonnet?” Open the hood of your car to offer an answer. |

|

While Americans look for a flashlight when power goes out, a torch is the preferred term for those outside of North America. |

|

Urban legend says that the Chevrolet Nova did not do well in Spanish speaking countries because the name translates as “no go.” The truth is that the car sold well in both Mexico and Venezuela. |

Key Takeaway

- Competing in international markets involves important opportunities and daunting threats. The opportunities include access to new customers, lowering costs, and diversification of business risk. The threats include political risk, economic risk, and cultural risk.

Exercises

- Is offshoring ethical or unethical? Why?

- Do you expect reshoring to become more popular in the years ahead? Why or why not?

- Have you ever seen an advertisement that was culturally offensive? Why do you think that companies are sometimes slow to realize that their ads will offend people?

References

CBS News. (2018, May 4). California now has the world’s 5th largest economy. https://www.cbsnews.com/news/california-now-has-the-worlds-5th-largest-economy/.

Copeland, L. (2010, March 25). Kia breathes life into old Georgia textile mill town. USA Today. http://www.usatoday.com/news/nation/2010-03-24-boomtown_N.htm.

Isidore, C. (2011, June 17). Made in USA: Overseas jobs come home. CNNMoney. http://money.cnn.com/2011/06/17/news/economy/made_in_usa/index.htm.

Kent, D. (2011, June 19). Kia production in Georgia helping companies across Alabama. al.com. http://blog.al.com/businessnews/2011/06/kia_production_in_georgia_help.html.

Kia. (n.d.). Frequently asked questions. Kia.com. http://www.kia.com/#/faq/.

Kia. (2020, September 7). Kia sales climb strongly in 10 countries in May [Press release]. Kia website. http://www.kia-press.com/press/corporate/20090605-kia%20sales%20 climb%20strongly%20in%2010%20countries.aspx.

Kostigen, T. (2011, February 25). Beware: The world’s riskiest countries. Market Watch. Wall Street Journal. http://www.marketwatch.com/story/beware-the -worlds-riskiest-countries-2011-02-25.

Maltby, E. (2010, January 19). Expanding abroad? Avoid cultural gaffes. Wall Street Journal. https://www.wsj.com/articles/SB10001424052748703657604575005511903147960.

Monroe Engineering. (2018, July 8). Study reveals which manufacturing companies are reshoring the most jobs. https://monroeengineering.com/blog/study-reveals-which-manufacturing-companies-are-reshoring-the-most-jobs/.

Reuters. (2020, January 6). GM’s China sales drop for second year on weak economy. https://www.reuters.com/article/us-gm-china/gms-2019-china-sales-drop-for-second-year-on-weak-economy-idUSKBN1Z606D.

Ricks, D. A. (1993). Blunders in international business. Cambridge, MA: Blackwell.

Sands, P. (2011, June 2). Kia Motors Manufacturing Georgia begins expansion projects to support increased volume beginning in 2012. Kia.com. https://www.kmmgusa.com/kia-motors-manufacturing-georgia-begins-expansion-projects-to-support-increased-volume-beginning-in-2012.

Statista. (2019). Revenue of McDonald’s corporation worldwide in 2019, by region. https://www.statista.com/statistics/219453/revenue-of-the-mcdonalds-corporation-by-geographic-region/.

The Two Malcontents. (2007, July 3). Clove-flavored Marlboro now in Indonesia. http://www.the-two-malcontents.com/2007/07/clove-flavored-marlboro- now-in-indonesia.

Image Credits

Figure 9.1: Buie. Kia. CC BY NC-ND 2.0. Retrieved from https://flic.kr/p/fFrmMd.

Figure 9.2: pngimg. KIA PNG. CC BY NC 4.0. Retrieved from https://pngimg.com/download/34351.

Figure 9.3: Kevin Poh. 2nd Putrajaya International Hot Air Balloon Fiesta 2010. CC BY 2.0. Retrieved from https://flic.kr/p/7LU5WU.

Figure 9.4: TruckPR (2017). “PacLease – PacCentrl Call Center 3.” CC BY NC-ND 2.0. Retrieved from: https://www.flickr.com/photos/truckpr/32885684382/.

Figure 9.5: 難波1丁目店(2006). “Ampm.” CC BY 3.0. Retrieved from: https://commons.wikimedia.org/wiki/File:Ampm.JPG.

Figure 9.6: Kindred Grey (2020). “The Game of Risk Origin.” CC BY NC SA 4.0. Image of map: voy:fr:Utilisateur:Fogg, Peter Fitzgerald (2013). “Continents colour2.” CC BY 3.0. Retrieved from: https://commons.wikimedia.org/wiki/File:Continents_colour2.svg Adaptation of Figure 7.2 from Mastering Strategic Management (2015) (CC BY NC SA 4.0). Retrieved from https://open.lib.umn.edu/app/uploads/sites/11/2015/04/e824628b82338249fd2d8359e2c6b403.jpg.

Figure 9.7: Agência Brasil (2008). CC BY 3.0 Brazil. Retrieved from: https://commons.wikimedia.org/wiki/File:Hugo_Chavez_in_Guatemala.jpg.

Figure 9.8: Quapan. “German Banks ‘Can Afford’ a Greek Debt Default.” CC BY 2.0. Retrieved from https://www.flickr.com/photos/hinkelstone/6309941378/.

How a firm conducts its business outside the borders of its home country

Created when the unit cost of goods and services decreases as a firm is able to produce and sell more items

Relocating a business activity to another country, such as manufacturing or a call center

Returning offshored jobs and activities back to the home country

Evaluation of six forces in an industry's macro-environment: political, economic, socio-cultural, technological, environmental, and legal.

The potential for government upheaval or interference with business to harm an operation within a country

The potential for a country’s economic conditions and policies, property rights protections, and currency exchange rates to harm a firm’s operations within a country

The potential for a company’s operations in a country to struggle because of differences in language, customs, norms, and customer preferences