Chapter 10: Executing Strategy through Organizational Design

10.2 Why Organizational Design?

Can Oil Well Services Fuel Success for General Electric?

In the spring of 2010 the Deepwater Horizon fire and oil spill in the Gulf of Mexico occurred. It resulted in 11 deaths, 17 injuries, and millions of barrels of oil contaminating the Gulf and US shoreline. As a result of this disaster, General Electric (GE) saw an opportunity. In February 2011, General Electric reached an agreement to acquire the well-support division of John Wood Group PLC for $2.8 billion. This was GE’s third acquisition of a company that provides services to oil wells in only five months. In October 2010, GE added the deepwater exploration capabilities of Wellstream Holdings PLC for $1.3 billion. In December 2010, part and equipment maker Dresser was acquired for $3 billion. By spending more than $7 billion on these acquisitions, GE executives made it clear that they had big plans within the oil well services business.

While many executives would struggle to integrate three new companies into their firms, experts expected GE’s leaders to smoothly execute the transitions. In describing the acquisition of John Wood Group PLC, for example, one Wall Street analyst noted, “This is a nice bolt-on deal for GE” (Layne, 2011). In other words, this analyst believed that John Wood Group PLC could be seamlessly added to GE’s corporate empire. The way that GE was organized fueled this belief.

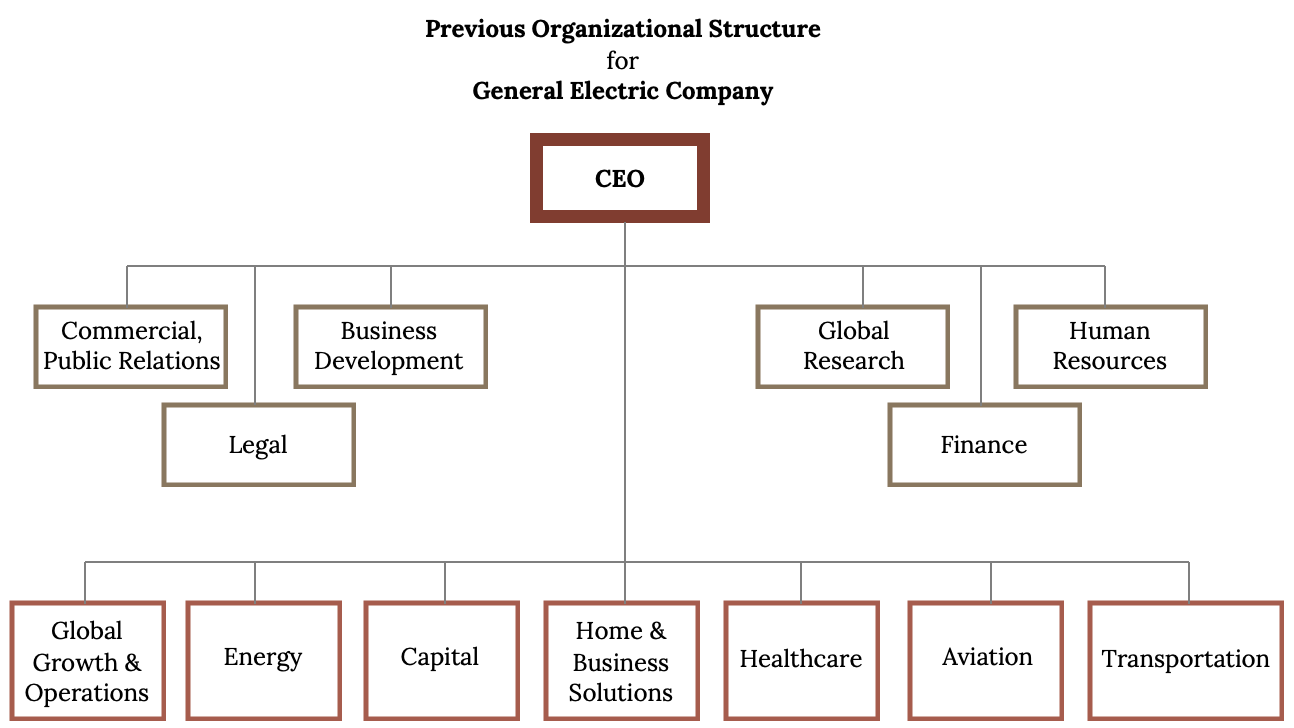

GE’s organizational structure includes six divisions, each devoted to specific product categories: (1) Energy (the most profitable division), (2) Capital (the largest division), (3) Home & Business Solutions, (4) Healthcare, (5) Aviation, and (6) Transportation. Within the Energy division, there are three subdivisions: (1) Oil & Gas, (2) Power & Water, and (3) Energy Services. Rather than having the entire organization involved with integrating John Wood Group PLC, Wellstream Holdings PLC, and Dresser into GE, these three newly acquired companies would simply be added to the Oil & Gas subdivisions within the Energy division.

In addition to the six product divisions, GE also had a division devoted to Global Growth & Operations. This division was responsible for all sales of GE products and services outside the United States. The Global Growth & Operations division was very important to GE’s future. Indeed, GE’s CEO Jeffrey Immelt expected that countries other than the United States will account for 60% of GE’s sales in the future, up from 53% in 2010. To maximize GE’s ability to respond to local needs, the Global Growth & Operations was further divided into twelve geographic regions: China, India, Southeast Asia, Latin/South America, Russia, Canada, Australia, the Middle East, Africa, Germany, Europe, and Japan (GE News Center, 2010).

Finally, like many large companies, GE also provided some centralized services to support all its units. These support areas included public relations, business development, legal, global research, human resources, and finance. By having entire units of the organization devoted to these functional areas, GE hoped not only to minimize expenses but also to create consistency across divisions.

Growing concerns about the environmental effects of drilling, for example, made it likely that GE’s oil well services operations would need the help of GE’s public relations and legal departments in the future. Other important questions about GE’s acquisitions remained open as well. In particular, would the organizational cultures of John Wood Group PLC, Wellstream Holdings PLC, and Dresser mesh with the culture of GE? Most acquisitions in the business world fail to deliver the results that executives expect, and the incompatibility of organizational cultures is one reason why.

This General Electric example highlights several concepts regarding the strategic role decisions about the organization. First, how large, complex organizations organize themselves impact how they accomplish their mission. Also, assessing the external environment can open up organizational opportunities. Third, how the acquisition and then integration of companies into the home firm can be challenging. And fourth, in hindsight, investing in the fossil fuel industry at a time of rising energy renewables was a strategic mistake. Since this time, GE has sold off many of its business lines for billions of dollars, and the downsized company is nowhere near the powerhouse it was a decade ago. GE is still struggling due to the strategic errors in a number of the industries it was involved in.

Firms must be organized in an optimal way to be able to compete and accomplish its mission. As noted in an earlier chapter, the external and competitive environments cannot be ignored. A firm must find the best “fit” to deal with the business environment and maximize its internal resources, capabilities, and core competencies. This organizational fit will determine its performance. It is unique to each organization; it is not “one size fits all.”

The business-level strategy that a firm selects impacts the organizational structure, with some structures better suited for certain strategies. There are trade-offs with each structure. The structure influences the firm’s ability to respond quickly to outside forces, its adaptability, resource efficiency, and accountability.

Walmart uses a functional organizational structure (described later in this chapter) because it is the best design to support a low cost strategy operating in a stable environment. A functional structure allows for excellent resource efficiency, but the trade off is a reduction in its adaptability and responsiveness to external forces (Harvard).

References

GE News Center. (2010, November 8). GE names vice chairman John Rice to lead GE Global Growth & Operations [Press release]. https://www.ge.com/news/press-releases/ge-names-vice-chairman-john-rice-lead-ge-global-growth-operations-0.

Layne, R. (2011, February 14). GE agrees to buy $2.8 billion oil-service unit; shares surge. Bloomsberg. https://www.bloomberg.com/news/articles/2011-02-14/ge-spending-spree-adds-2-8-billion-john-wood-oil-service-unit.

Image Credits

Figure 10.1: The General Electric Company. “The original version of the circular logo and trademark of the General Electric Company.” Public Domain. Retrieved from https://en.wikipedia.org/wiki/File:Early_General_Electric_logo_1899.png.

Figure 10.2: Kindred Grey (2020). “GE Organizational Structure” CC BY NC SA 3.0. Adaptation of Figure from Mastering Strategic Management (2015) (CC BY NC SA 3.0). Retrieved from https://open.lib.umn.edu/app/uploads/sites/11/2015/04/2dbd51773248b81bf185da22059b385a.jpg.