Chapter 7: Innovation Strategies

7.5 Implementing Innovation

Product Life Cycle and Crossing the Chasm

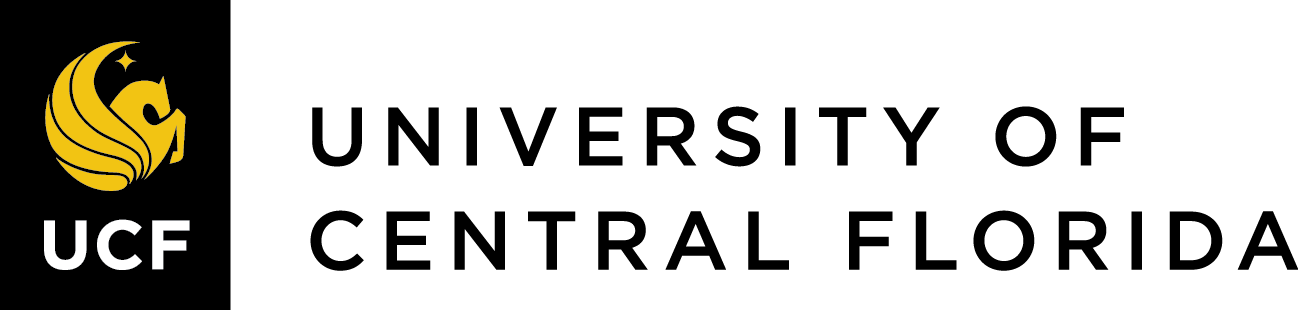

When innovation creates a new product, it typically goes through four stages within the marketplace. This is true whether it is a high-tech product like a new video game system or a more mundane product like a laundry detergent. The four stages are:

- Introduction: The product is launched, with the hopes that it catches on. Sales are low.

- Growth: The product catches on, and sales increase with time. Competitors jump in, but the rivalry among competitors is not really strong yet, and there are plenty of sales for all.

- Maturity: Sales begin to level out, growth slows, and competition increases. Shake-out occurs, with some competitors leaving the market or being acquired by others.

- Decline: Sales start declining. More consolidation occurs, with firms looking for exit strategies. A few firms remain.

![An xy plot showing Sales over Time. The plot is broken into 4 time increments: Introduction (low sales, high cost per customer, financial losses, innovative customers, few [if any] competitors), Growth (increasing sales, cost per customer falls, profits rise, increasing number of customers, more competitors), Maturity (peak sales, cost per customer lowest, profits high, mass market, stable number of competitors), Decline (falling sales, cost per customer low, profits fall, customer base contracts, number of competitors fall). A line underneath the text follows a bell shaped curve with its peak during the Maturity stage.](https://pressbooks.online.ucf.edu/app/uploads/sites/1889/2020/05/productlifecycle-1-1024x524.png)

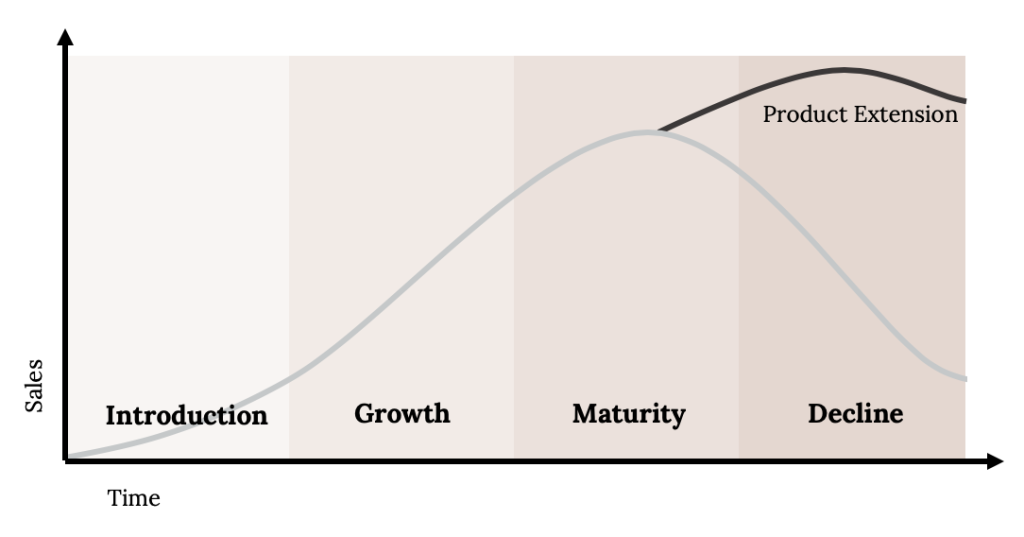

Figure 7.5 illustrates these four stages over time. To prevent the decline of their product after the maturity stage, firms will often “relaunch” their product with a new and improved model. Innovation again plays a role, making improvements to the product, so that consumers will purchase the latest model. Prime examples of incremental innovation strategy are Apple’s iPhone and car manufacturers, such as Ford and Toyota. In essence, the new model starts the product life cycle all over again. Figure 7.6 illustrates this concept.

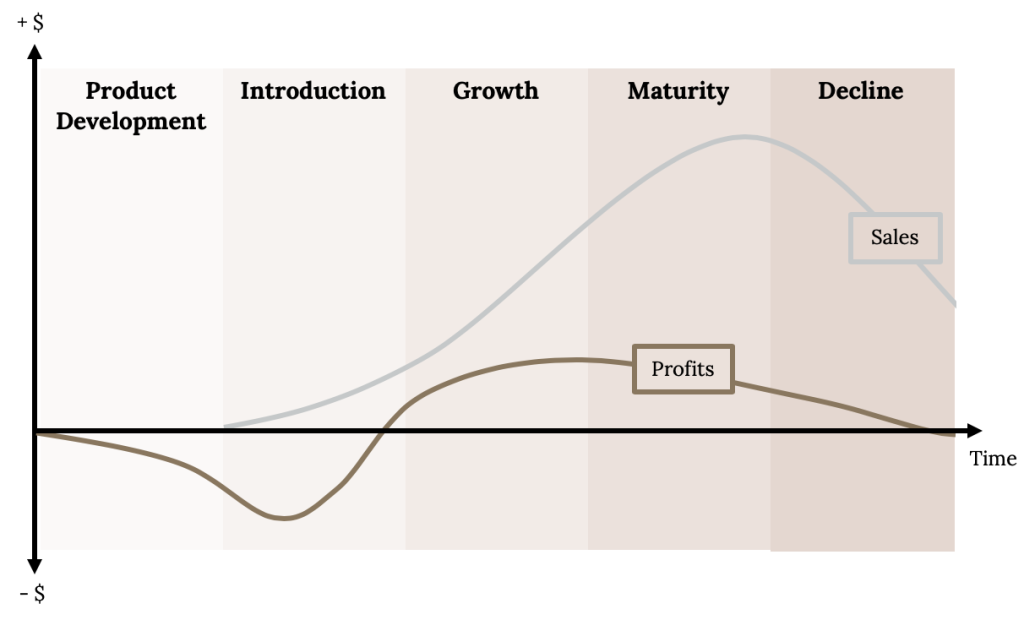

Profits generated during the product life cycle also usually follow a traditional pattern. During the research and development phase of the product, the firm is investing funds into the product, generating a negative profit. Losses continue during the introduction phase, when sales are low and marketing expenses are high. Firms tend to recoup their investment in R&D and marketing during the growth phase, with maximum profits at the beginning of the maturity phase. Once competition heats up in the maturity phase, price competition kicks in, and lower prices mean lower profits. Figure 7.7 illustrates the profits during the four phases of the product life cycle.

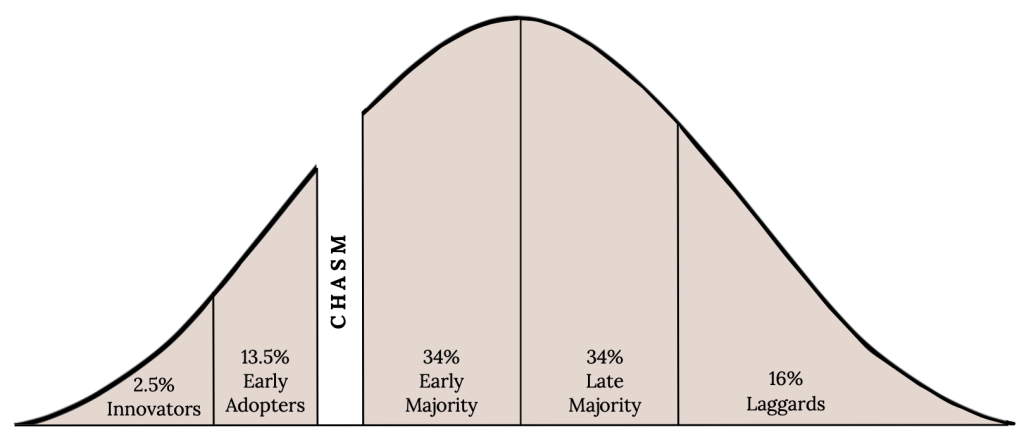

Another phenomenon that occurs in the innovation process with new technology is called “crossing the chasm.” When a new technology is launched, often there are technology innovators/enthusiasts who will purchase the new technology to check it out. A few more, called early adopters, will also want to try out the new product. But how does the firm get the product into the mainstream market? How do they get it to catch on? This can often be challenging. Can the product make the leap to the mainstream? This is called “crossing the chasm,” and often requires a different marketing approach.

Figure 7.6 illustrates this concept, breaking down the market into customer segments. Innovators and early adopters make up about 15% of the market. Firms must determine a business strategy for each segment of the market. If they cannot convince the early majority to buy their product, the product fails. Google Glass is an example of a product that did not cross the chasm. Eyeglasses connected to the internet were quite an innovative product, projecting internet sites in front of the eyes, or allowing the wearer to take pictures. Its true usefulness, however, was questionable, and aside from some early adopters, it failed.

Where is the electric car in this technology adoption life cycle? The purchase of electric cars has certainly been growing. Have they crossed the chasm? In 2019, approximately 2.2% of all car sales were electric plug-in vehicles (Coran, 2019). Electric vehicles still need to cross the chasm. The lack of charging stations across the nation and concern for running out of battery are limiting factors preventing the electric vehicle from selling to the early majority.

Making Cooperative Moves

Franklin Roosevelt once quipped, “Competition has been shown to be useful up to a certain point and no further, but cooperation, which is the thing we must strive for today, begins where competition leaves off.” We illustrate four commonly used cooperative moves used by firms below.

| Joint Ventures | Joint ventures involve two or more organizations that contribute to the creation of a new entity. For example, Hong Kong Disneyland is a joint venture between the government of Hong Kong and the Walt Disney Company. While the park consists of Disney mainstays such as Main Street, USA, Fantasyland, Adventureland, and Tomorrowland, the park also incorporates elements of Chinese culture such as adherence to the rules of Feng Shui—a set of aesthetic design principles believed to promote positive energy. |

| Strategic Alliances | Strategic alliances are cooperative arrangements governed by contract between two or more organizations that do not involve creating new entities. For example, a strategic alliance between Merck and PAREXEL International Corporation was formed with the goal of collaborating on biotechnology efforts known as biosimilars—a term used to describe subsequent versions of innovative drugs. |

| Mergers and Acquisitions | Mergers and Acquisitions combine two organizations into one. Mergers typically occur between like-size firms. Sprint and T-Mobile merged to create a stronger force in the wireless communications industry. Acquisitions usually are done by larger companies acquiring smaller ones, as when Google acquired Fitbit. |

In addition to competitive moves, firms can benefit from cooperating with one another. Cooperative moves such as forming joint ventures and strategic alliances may allow firms to enjoy successes that might not otherwise be reached (Table 7.9). This is because cooperation enables firms to share rather than duplicate resources and to learn from one another’s strengths. Firms that enter cooperative relationships take on risks, however, including the loss of control over operations, possible transfer of valuable secrets to other firms, and possibly being taken advantage of by partners (Ketchen et al., 2004).

Joint Ventures

A joint venture is a cooperative arrangement that involves two or more organizations with each contributing to the creation of a new entity. The partners in a joint venture share decision-making authority, control of the operation, and any profits that the joint venture earns.

Sometimes two firms create a joint venture to deal with a shared opportunity. A joint venture was created between Merck and Sun Pharmaceutical Industries Ltd., an Indian pharmaceutical company. The purpose of the joint venture was to create and sell generic drugs in developing countries. In a press release, a top executive at Sun stressed that each side has important strengths to contribute: “This joint venture reinforces [Sun’s] strategy of partnering to launch products using our highly innovative delivery technologies around the world. Merck has an unrivaled reputation as a world leading, innovative, research-driven pharmaceutical company” (Merck, 2011). Both firms contributed executives to the new organization, reflecting the shared decision making and control involved in joint ventures.

In other cases, a joint venture is designed to counter a shared threat. Brewers SABMiller and Molson Coors Brewing Company created a joint venture called MillerCoors that combines the firms’ beer operations in the United States. Miller and Coors found it useful to join their US forces to better compete against their giant rival Anheuser-Busch, while the two parent companies still remain separate. The joint venture controls a wide array of brands, including Miller Lite, Coors Light, Blue Moon Belgian White, Coors Banquet, Foster’s, Henry Weinhard’s, Icehouse, Keystone Premium, Leinenkugel’s, Killian’s Irish Red, Miller Genuine Draft, Miller High Life, Milwaukee’s Best, Molson Canadian, Peroni Nastro Azzurro, Pilsner Urquell, and Red Dog. This diverse portfolio makes MillerCoors a more potent adversary for Anheuser-Busch than either Miller or Coors would be on their own.

Strategic Alliances

A strategic alliance is a cooperative arrangement between two or more organizations that does not involve the creation of a new entity. For example, Twitter formed a strategic alliance with Yahoo! Japan. The alliance involved relevant Tweets appearing within various functions offered by Yahoo! Japan (Rao, 2011). The alliance simply involves the two firms collaborating through a contractual relationship as opposed to creating a new entity together.

The pharmaceutical industry is the location of many strategic alliances. In another example, Merck and PAREXEL International Corporation engaged in a strategic alliance. Within this alliance, the two companies collaborate on biotechnology efforts known as biosimilars. This alliance could be quite important to Merck because the global market for biosimilars has been predicted to rise significantly (PRWeb, 2011).

Mergers and Acquisitions

Another way for firms to cooperate to the advantage of both firms and their stockholders is through mergers. Two firms decide to combine into one entity, often gaining strength in the market. The merger of T-Mobile and Sprint is a prime example. As the number three and four players in the wireless communications industry, combining forces makes the new firm a much stronger competitor against AT&T and Verizon. Sometimes both firms’ identities remain in the name of the new company, such as with the merger of Exxon and Mobil oil companies to ExxonMobil. At other times, only one of the firm’s names remains, or a new name is selected for the merged companies.

Whereas mergers typically occur with like-size companies, acquisitions are usually done by the larger firm acquiring the smaller firm. The end result is basically the same, with two companies combining into one. Sometimes the acquired firm is absorbed into the acquiring company, but sometime it retains its identity. Besides combining the strengths of both organizations with the intent of having a stronger performing company, mergers and acquisitions reduce the number of competitors in the industry.

Mergers and acquisitions are not without risk, however. According to a Harvard Business Review report, the failure rate of mergers and acquisitions is between 70% – 90% (Lakelet Capital, 2019). Often, the enthusiasm of the perceived benefits of the merger overshadow the challenges of adapting two organizational cultures into one, the total costs of the venture, and/or dealing with different technical systems. Also, an acquisition is a quick way to increase firm revenues, a metric that may incentivize CEOs to acquire another firm without adequate due diligence, creating an agency problem, which is discussed in Chapter 11 on ethics.

Internal Development

Another method to expand a firm is through internal development. If a firm wants to add a new product or service line, rather than acquire that expertise by buying a company, the firm can develop that capability themselves. Although this is more of a competitive rather than a cooperative move, this is where a firm’s strength of entrepreneurial orientation (EO) comes into play, and when intrapreneurship is important. Instead of acquiring Fitbit, Google could have developed this wearable technology internally by hiring those with the expertise and paying for the research and development for product development to enter this market.

Key Takeaways

- New products and services typically follow a predictable product life cycle, and must be able to “cross the chasm” to attract buyers beyond the early adopters.

- Sometimes it is advantageous for a firm to make a cooperative move with a competitor, with strategies such as a joint venture, strategic alliance, merger, or acquisition. Internal development is also a method to add innovative capability.

Exercises

- What are examples of firms that “relaunch” their products once in the maturity stage of the product life cycle?

- Why might local restaurants not be in the position to respond to large franchises or chains? What can local restaurants do to avoid being ruined by chain restaurants?

- How could a family jewelry store use one of the cooperative moves mentioned in this section?? What type of organization might be a good cooperative partner for a family jewelry store?

- What are some reasons why a merger between Ford and Volkswagen might fail?

References

Coran, M. (2019, December 6). 2019 was the year electric cars grew up. Quartz. https://qz.com/1762465/2019-was-the-year-electric-cars-grew-up/#:~:text=Electric%20vehicles%20(EVs)%20grabbed%202.2,new%20models%20hit%20the%20road.

Ketchen, D. J., Snow, C., & Street, V. (2004). Improving firm performance by matching strategic decision making processes to competitive dynamics. Academy of Management Executive, 19(4) 29-43.

Lakelet Capital. (2019, June 15). Reasons shy mergers & acquisitions fail and succeed. https://lakeletcapital.com/reasons-why-mergers-acquisitions-fail-and-succeed/#:~:text=According%20to%20collated%20research%20and,70%20percent%20and%2090%20percent.

Merck & Co., Inc., and Sun Pharma establish joint venture to develop and commercialize novel formulations and combinations of medicines in emerging markets [Press release]. 2011, April 11. Merck website. Retrieved from https://web.archive.org/web/20110608025556/http://www.merck.com/licensing/our-partnership/sun-partnership.html.

PRWeb, Global biosimilars market to reach US$4.8 billion by 2015, according to a new report by Global Industry Analysts, Inc. [Press release]. 2011, February 15. PRWeb website. Retrieved from http://www.prweb.com/releases/biosimilars/human_growth _hormone/prweb8131268.htm.

Rao, L. 2011, June 14. Twitter announces “strategic alliance” with Yahoo Japan [Blog post]. Techcrunch website. Retrieved from http://www.techcrunch.com/2011/06/14/twitter-announces-firehose-partnership-with-yahoo-japan.

Ritson, M. (2009, October). Should you launch a fighter brand? Harvard Business Review, 65–81.

Image Credits

Figure 7.5: Kindred Grey (2020). “Product Life Cycle.” CC BY-SA 4.0. Retrieved from https://commons.wikimedia.org/wiki/File:Product_Life_Cycle.png. Adapted from https://marketing-insider.eu/wp-content/uploads/2017/07/Characteristics-of-the-Product-Life-Cycle-Stages-and-their-Marketing-Implications.png.

Figure 7.6: Kindred Grey (2020). “Product Extension and the product life cycle.” CC BY-SA 4.0. Retrieved from https://commons.wikimedia.org/wiki/File:Product_Extension_and_the_product_life_cycle.png. Adapted from https://marketing-insider.eu/wp-content/uploads/2017/07/Characteristics-of-the-Product-Life-Cycle-Stages-and-their-Marketing-Implications.png.

Figure 7.7: Kindred Grey (2020). “Difference between profits and sales.” CC BY-SA 4.0. Retrieved from https://commons.wikimedia.org/wiki/File:Difference_between_profits_and_sales.png. Adapted from https://marketing-insider.eu/wp-content/uploads/2017/07/Characteristics-of-the-Product-Life-Cycle-Stages-and-their-Marketing-Implications.png.

Figure 7.8: Kindred Grey (2020). “Technology adoption life cycle – breaking the chasm.” CC BY-SA 4.0. Retrieved from https://commons.wikimedia.org/wiki/File:Technology_adoption_life_cycle_-_breaking_the_chasm.png. Adapted from http://www.themarketingstudent.com/wp-content/uploads/2017/04/chasm-adoption-lifecycle.jpeg.

Figure 7.9: Unknown Author. “ExxonMobil logo.” Public Domain, Trademarked logo. Retrieved from https://commons.wikimedia.org/wiki/File:ExxonMobil_Logo.svg.

A cooperative arrangement that involves two or more organizations each contributing to the creation of a jointly owned, new company

A cooperative arrangement governed by contract between two or more organizations for their mutual benefit.

When one firm, usually the larger one, buys another firm

Adding new capabilities or products and services using a firm’s resources or hiring those resources