Chapter 16: Domestic Policy

Budgeting and Tax Policy

LEARNING OUTCOMES

By the end of this section, you will be able to:

- Discuss economic theories that shape U.S. economic policy

- Explain how the government uses fiscal policy tools to maintain a healthy economy

- Analyze the taxing and spending decisions made by Congress and the president

- Discuss the role of the Federal Reserve Board in monetary policy

A country spends, raises, and regulates money in accordance with its values. In all, the federal government’s budget for 2020 was $6.55 trillion. This chapter has provided a brief overview of some of the budget’s key areas of expenditure, and thus some insight into modern American values. But these values are only part of the budgeting story. Policymakers make considerable effort to ensure that long-term priorities are protected from the heat of the election cycle and short-term changes in public opinion. The decision to put some policymaking functions out of the reach of Congress also reflects economic philosophies about the best ways to grow, stimulate, and maintain the economy. The role of politics in drafting the annual budget is indeed large, but we should not underestimate the challenges elected officials face as a result of decisions made in the past.

APPROACHES TO THE ECONOMY

Until the 1930s, most policy advocates argued that the best way for the government to interact with the economy was through a hands-off approach formally known as laissez-faire economics. These policymakers believed the key to economic growth and development was the government’s allowing private markets to operate efficiently. Proponents of this school of thought believed private investors were better equipped than governments to figure out which sectors of the economy were most likely to grow and which new products were most likely to be successful. They also tended to oppose government efforts to establish quality controls or health and safety standards, believing consumers themselves would punish bad behavior by not trading with poor corporate citizens. Finally, laissez-faire proponents felt that keeping government out of the business of business would create an automatic cycle of economic growth and contraction. Contraction phases in which there is no economic growth for two consecutive quarters, called recessions, would bring business failures and higher unemployment. But this condition, they believed, would correct itself on its own if the government simply allowed the system to operate.

The Great Depression challenged the laissez-faire view, however. When President Franklin Roosevelt came to office in 1933, the United States had already been in the depths of the Great Depression for several years, since the stock market crash of 1929. Roosevelt sought to implement a new approach to economic regulation known as Keynesianism. Named for its developer, the economist John Maynard Keynes, Keynesian economics argues that it is possible for a recession to become so deep, and last for so long, that the typical models of economic collapse and recovery may not work. Keynes suggested that economic growth was closely tied to the ability of individuals to consume goods. It didn’t matter how or where investors wanted to invest their money if no one could afford to buy the products they wanted to make. And in periods of extremely high unemployment, wages for newly hired labor would be so low that new workers would be unable to afford the products they produced.

Keynesianism counters this problem by increasing government spending in ways that improve consumption. Some of the proposals Keynes suggested were payments or pension for the unemployed and retired, as well as tax incentives to encourage consumption in the middle class. His reasoning was that these individuals would be most likely to spend the money they received by purchasing more goods, which in turn would encourage production and investment. Keynes argued that the wealthy class of producers and employers had sufficient capital to meet the increased demand of consumers that government incentives would stimulate. Once consumption had increased and capital was flowing again, the government would reduce or eliminate its economic stimulus, and any money it had borrowed to create it could be repaid from higher tax revenues.

Keynesianism dominated U.S. fiscal or spending policy from the 1930s to the 1970s. By the 1970s, however, high inflation began to slow economic growth. There were a number of reasons, including higher oil prices and the costs of fighting the Vietnam War. However, some economists, such as Arthur Laffer, began to argue that the social welfare and high tax policies created in the name of Keynesianism were overstimulating the economy, creating a situation in which demand for products had outstripped investors’ willingness to increase production.[1] They called for an approach known as supply-side economics, which argues that economic growth is largely a function of the productive capacity of a country. Supply-siders have argued that increased regulation and higher taxes reduce the incentive to invest new money into the economy, to the point where little growth can occur. They have advocated reducing taxes and regulations to spur economic growth.

MANDATORY SPENDING VS. DISCRETIONARY SPENDING

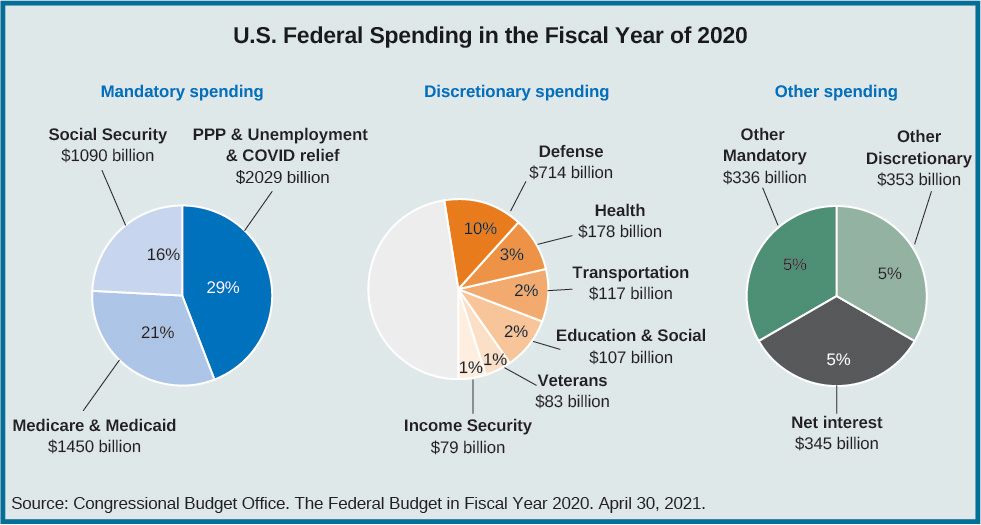

The desire of Keynesians to create a minimal level of aggregate demand, coupled with a Depression-era preference to promote social welfare policy, led the president and Congress to develop a federal budget with spending divided into two broad categories: mandatory and discretionary (see Figure 16.15). Of these, mandatory spending is the larger, consisting of about $4.9 trillion of the 2020 budget, or roughly 71 percent of all federal expenditures.[2]

The overwhelming portion of mandatory spending is earmarked for entitlement programs guaranteed to those who meet certain qualifications, usually based on age, income, or disability. These programs, discussed above, include Medicare and Medicaid, Social Security, and major income security programs such as unemployment insurance and SNAP. The costs of programs tied to age are relatively easy to estimate and grow largely as a function of the aging of the population. Income and disability payments are a bit more difficult to estimate. They tend to go down during periods of economic recovery and rise when the economy begins to slow down, in precisely the way Keynes suggested. A comparatively small piece of the mandatory spending pie, about 14 percent, is devoted to benefits designated for former federal employees, including military retirement and many Veterans Administration programs.

Congress is ultimately responsible for setting the formulas for mandatory payouts, but as we saw in the earlier discussion regarding Social Security, major reforms to entitlement formulas are difficult to enact. As a result, the size and growth of mandatory spending in future budgets are largely a function of previous legislation that set the formulas up in the first place. So long as supporters of particular programs can block changes to the formulas, funding will continue almost on autopilot. Keynesians support this mandatory spending, along with other elements of social welfare policy, because they help maintain a minimal level of consumption that should, in theory, prevent recessions from turning into depressions, which are more severe downturns.

Portions of the budget not devoted to mandatory spending are categorized as discretionary spending because Congress must pass legislation to authorize money to be spent each year. About 50 percent of the approximately $1.2 trillion set aside for discretionary spending each year pays for most of the operations of government, including employee salaries and the maintenance of federal buildings. It also covers science and technology spending, foreign affairs initiatives, education spending, federally provided transportation costs, and many of the redistributive benefits most people in the United States have come to take for granted.[3] The other half of discretionary spending—and the second-largest component of the total budget—is devoted to the military. (Only Social Security is larger.) Defense spending is used to maintain the U.S. military presence at home and abroad, procure and develop new weapons, and cover the cost of any wars or other military engagements in which the United States is currently engaged (Figure 16.16).

In theory, the amount of revenue raised by the national government should be equal to these expenses, but with the exception of a brief period from 1998 to 2000, that has not been the case. The economic recovery from the 2007–2009 recession, and budget control efforts implemented in the early 2010s, managed to cut the annual deficit—the amount by which expenditures are greater than revenues—by more than half by 2015. However, the amount of money the U.S. government needed to borrow to pay its bills in 2016 was still in excess of $400 billion[4]. This was in addition to the country’s almost $19 trillion of total debt—the amount of money the government owes its creditors—at the end of 2015, according to the Department of the Treasury.[5] The total debt as of March 2021 is $22 trillion.

Balancing the budget has been a major goal of both the Republican and Democratic parties for the past several decades, although the parties tend to disagree on the best way to accomplish the task. One frequently offered solution, particularly among supply-side advocates, is to simply cut spending. This has proven to be much easier said than done. If Congress were to try to balance the budget only through discretionary spending, it would need to cut about one-third of spending on programs like defense, higher education, agriculture, police enforcement, transportation, and general government operations. Given the number and popularity of many of these programs, it is difficult to imagine this would be possible. To use spending cuts alone as a way to control the deficit, Congress will almost certainly be required to cut or control the costs of mandatory spending programs like Social Security and Medicare—a radically unpopular step.

*This video explains more about the government’s role in regulating the economy.

TAX POLICY

The other option available for balancing the budget is to increase revenue. All governments must raise revenue in order to operate. The most common way is by applying some sort of tax on residents (or on their behaviors) in exchange for the benefits the government provides (Figure 16.17). As necessary as taxes are, however, they are not without potential downfalls. First, the more money the government collects to cover its costs, the less residents are left with to spend and invest. Second, attempts to raise revenues through taxation may alter the behavior of residents in ways that are counterproductive to the state and the broader economy. Excessively taxing necessary and desirable behaviors like consumption (with a sales tax) or investment (with a capital gains tax) will discourage citizens from engaging in them, potentially slowing economic growth. The goal of tax policy, then, is to determine the most effective way of meeting the nation’s revenue obligations without harming other public policy goals.

As you would expect, Keynesians and supply-siders disagree about which forms of tax policy are best. Keynesians, with their concern about whether consumers can really stimulate demand, prefer progressive taxes systems that increase the effective tax rate as the taxpayer’s income increases. This policy leaves those most likely to spend their money with more money to spend. For example, in 2015, U.S. taxpayers who were married and filing jointly paid a 10 percent tax rate on the first $18,450 of income, but 15 percent on the next $56,450 (some income is excluded).[6] The rate continued to rise, to up to 39.6 percent on any taxable income over $464,850. Following the passage of the Tax Cuts and Jobs Act of 2017, these tax brackets were shifted. While the lowest bracket remained at a rate of 10 percent, the highest tax rate was reduced from 39.6 to 37 percent. These brackets are somewhat distorted by the range of tax credits, deductions, and incentives the government offers, but the net effect is that the top income earners pay a greater portion of the overall income tax burden than do those at the lowest tax brackets. According to the Pew Research Center, based on tax returns in 2014, 2.7 percent of filers made more than $250,000. Those 2.7 percent of filers paid 52 percent of the income tax paid.[7]

Supply-siders, on the other hand, prefer regressive tax systems, which lower the overall rate as individuals make more money. This does not automatically mean the wealthy pay less than the poor, simply that the percentage of their income they pay in taxes will be lower. Consider, for example, the use of excise taxes on specific goods or services as a source of revenue.[8] Sometimes called “sin taxes” because they tend to be applied to goods like alcohol, tobacco, and gasoline, excise taxes have a regressive quality, since the amount of the good purchased by the consumer, and thus the tax paid, does not increase at the same rate as income. A person who makes $250,000 per year is likely to purchase more gasoline than a person who makes $50,000 per year (Figure 16.18). But the higher earner is not likely to purchase five times more gasoline, which means the proportion of income paid out in gasoline taxes is less than the proportion for a lower-earning individual.

Another example of a regressive tax paid by most U.S. workers is the payroll tax that funds Social Security. While workers contribute 7.65 percent of their income to pay for Social Security and their employers pay a matching amount, in 2015, the payroll tax was applied to only the first $118,500 of income. Individuals who earned more than that, or who made money from other sources like investments, saw their overall tax rate fall as their income increased.

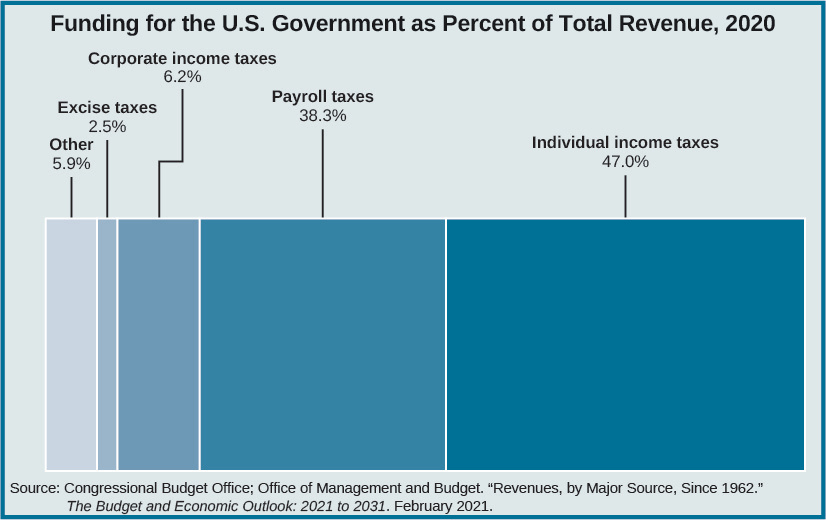

In 2020, the United States raised about $3.4 trillion in revenue. Income taxes ($1.61 trillion), payroll taxes on Social Security and Medicare ($1.31 trillion), and excise taxes ($87 billion) make up three of the largest sources of revenue for the federal government. When combined with corporate income taxes ($212 billion), these four tax streams make up about 95 percent of total government revenue. The balance of revenue is split nearly evenly between revenues from the Federal Reserve and a mix of revenues from import tariffs, estate and gift taxes, and various fees or fines paid to the government (Figure 16.19). The Tax Cuts and Jobs Act, which was passed in December 2017 by the Republican-controlled Congress and significantly reduced the income tax rate paid by corporations, has led to a widening budget deficit. November 2018 featured the largest single-month deficit in the history of the country, with $411 billion in spending and only $206 billion in receipts, and the annual budget shortfall is approaching $1 trillion.[9]

THE FEDERAL RESERVE BOARD AND INTEREST RATES

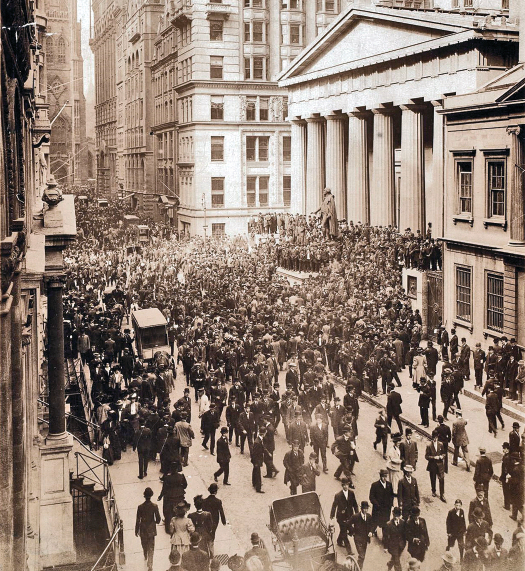

Financial panics arise when too many people, worried about the solvency of their investments, try to withdraw their money at the same time. Such panics plagued U.S. banks until 1913 (Figure 16.20), when Congress enacted the Federal Reserve Act. The act established the Federal Reserve System, also known as the Fed, as the central bank of the United States. The Fed’s three original goals to promote were maximum employment, stable prices, and moderate long-term interest rates.[10] All of these goals bring stability. The Fed’s role is now broader and includes influencing monetary policy (the means by which the nation controls the size and growth of the money supply), supervising and regulating banks, and providing them with financial services like loans.

The Federal Reserve System is overseen by a board of governors, known as the Federal Reserve Board. The president of the United States appoints the seven governors, each of whom serves a fourteen-year term (the terms are staggered). A chair and vice chair lead the board for terms of four years each. The most important work of the board is participating in the Federal Open Market Committee to set monetary policy, like interest rate levels and macroeconomic policy. The board also oversees a network of twelve regional Federal Reserve Banks, each of which serves as a “banker’s bank” for the country’s financial institutions.

INSIDER PERSPECTIVE

The Role of the Federal Reserve Chair

If you have read or watched the news for the past several years, perhaps you have heard the names Janet Yellen, Ben Bernanke, or Alan Greenspan. Bernanke, Greenspan, and Yellen are all recent past chairs of the board of governors of the Federal Reserve System; Bernanke, Greenspan, and Yellen (Figure 16.21) are all recent past chairs of the board of governors of the Federal Reserve System; Jerome Powell is the current chair. The role of the Fed chair is one of the most important in the country. By raising or lowering banks’ interest rates, the chair has the ability reduce inflation or stimulate growth. The Fed’s dual mandate is to keep inflation low (under 2 percent) and unemployment low (below 5 percent), but efforts to meet these goals can often lead to contradictory monetary policies.

The Fed, and by extension its chair, have a tremendous responsibility. Many of the economic events of the past five decades, both good and bad, are the results of Fed policies. In the 1970s, double-digit inflation brought the economy almost to a halt, but when Paul Volcker became chair in 1979, he raised interest rates and jump-started the economy. After the stock market crash of 1987, then-chair Alan Greenspan declared, “The Federal Reserve, consistent with its responsibilities as the nation’s central bank, affirmed today its readiness to…support the economic and financial system.”[11] His lowering of interest rates led to an unprecedented decade of economic growth through the 1990s. In the 2000s, consistently low interest rates and readily available credit contributed to the sub-prime mortgage boom and subsequent bust, which led to a global economic recession beginning in 2008.

Should the important tasks of the Fed continue to be pursued by unelected appointees like those profiled in this box, or should elected leaders be given the job? Why?

LINK TO LEARNING

CHAPTER REVIEW

See the Chapter 16.5 Review for a summary of this section, the key vocabulary, and some review questions to check your knowledge.

- Arthur B. Laffer, Stephen Moore and Peter J. Tanous. 2009. The End of Prosperity: How Higher Taxes Will Doom the Economy. New York: Simon & Schuster ↵

- “Mandatory Spending in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51111 (March 1, 2016) ↵

- “Discretionary Spending in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51112 (March 1, 2016) ↵

- “The Federal Budget in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51110 (March 1, 2016) ↵

- "The Current Federal Deficit and Debt," Peter G. Peterson Foundation, https://www.pgpf.org/the-current-federal-budget-deficit (June 1, 2021) ↵

- “2015 Federal Tax Rates, Personal Exemptions, and Standard Deductions,” http://www.irs.com/articles/2015-federal-tax-rates-personal-exemptions-and-standard-deductions (March 1, 2016) ↵

- “High income Americans pay most income taxes, but enough to be ‘fair’?” http://www.pewresearch.org/fact-tank/2016/04/13/high-income-americans-pay-most-income-taxes-but-enough-to-be-fair/ (March 1, 2016) ↵

- “Excise tax,” https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Excise-Tax (March 1, 2016) ↵

- "United States Posts Record Budget Deficit in November." Washington Post. 13 December 2018. https://www.washingtonpost.com/business/economy/united-states-posts-record-budget-deficit-in-november/2018/12/13/3cdb2310-fef3-11e8-83c0-b06139e540e5_story.html?utm_term=.d4eb59c09004 ↵

- “U.S. Code § 225a - Maintenance of long run growth of monetary and credit aggregates,” https://www.law.cornell.edu/uscode/text/12/225a (March 1, 2016) ↵

- https://www.federalreserveeducation.org/about-the-fed/history (March 1, 2016) ↵

an economic policy that assumes the key to economic growth and development is for the government to allow private markets to operate efficiently without interference

a temporary contraction of the economy in which there is no economic growth for two consecutive quarters

an economic policy based on the idea that economic growth is closely tied to the ability of individuals to consume goods

an economic policy that assumes economic growth is largely a function of a country’s productive capacity

government spending earmarked for entitlement programs guaranteeing support to those who meet certain qualifications

government spending that Congress must pass legislation to authorize each year

the annual amount by which expenditures are greater than revenues

the total amount the government owes across all years

a tax that tends to increase the effective tax rate as the wealth or income of the tax payer increases

a tax applied at a lower overall rate as individuals’ income rises

taxes applied to specific goods or services as a source of revenue